- INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 MANUAL

- INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 UPGRADE

- INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 FULL

- INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 SOFTWARE

This will help get some customized features of the non-profit version and save money too. Note: Unless you really need the standalone non-profit specific QuickBooks 2019, just get the regular Quickbooks premier version and choose “non-profit” as your industry. It also includes features such as class and location tracking and budgeting in its online version.

INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 MANUAL

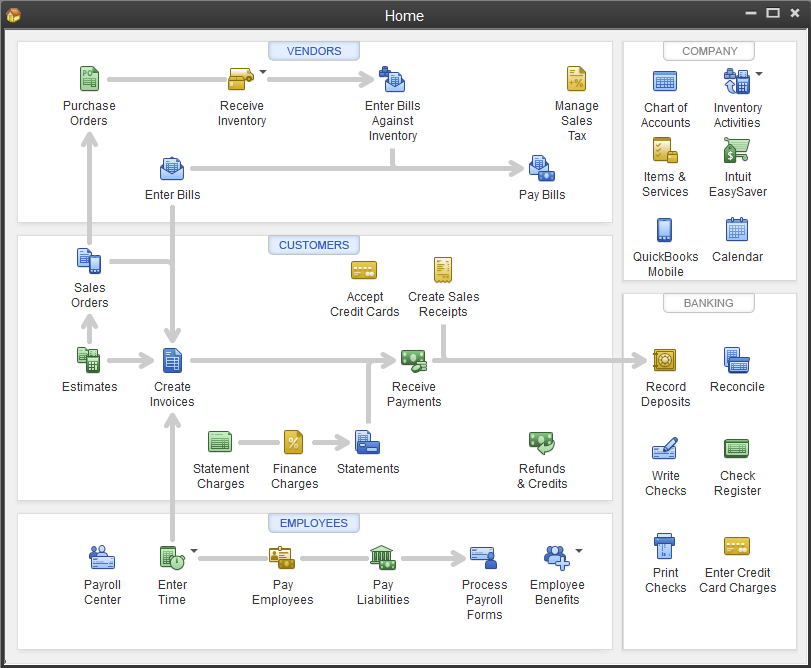

You can run reports analyze graphs for trends using some very specific data pointsĪutomation features such as bank feeds connects bank and credit card accounts to QB whereby recurring transactions gets auto-posted and significantly reduce the time taken in manual data entry.

It can run on a desktop and on a networked platform. The package allows for up to five users to be added. Intuit maintains their ever popular consistency across versions which make it easy to transition from one version to another.

INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 SOFTWARE

It’s low cost and one of the easiest bookkeeping software free from bugs with a very good all-round tax support structure. This easy-to-deploy intuitive software has a simple and an easy to use interface. QB for Non-profits is the easiest accounting software you can ask for:Īnyone can use this App without any previous financial or bookkeeping background.

Offers integration with Donor, Paypal and Square invoicing besides doing regular billing and invoicing and Inventory tracking and reporting Syncs bank accounts with QuickBooks to enables downloading, tracking and categorizing of expenses automatically Prepares form 1099 with series of documentation to be submitted to the IRS and treatment of accounts of NFP as specified by FASB in accordance with the GAAP & SFAS (116 & SFAS 117 norms) Help to make presentations related to expenses in an easy format to be presented to the board members, major donors, and the IRS. Statement of Functional Expenses (Create Form 990).

Includes All Accounting Features Requested By Non-profit Organizations.The software also includes nifty features like custom letters for acknowledging donations and fundraising.

INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 FULL

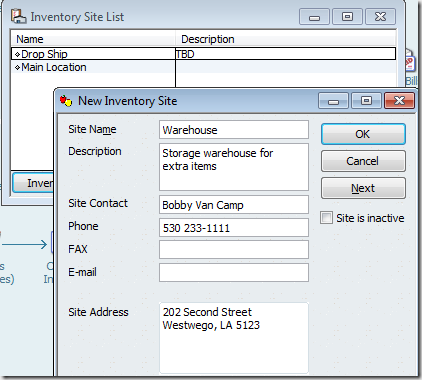

It’s a full package that includes class tracking, budgets by class or donor, integrates accounts receivable and payable as well in the software. An Overview of QB 2019 for Non-Profits NonProfit Version of QB Premier 2019

INTUIT QUICKBOOKS PREMIER CONTRACTOR 2011 UPGRADE

Check out QuickBooks 2019 Cost for Upgrade before to find out full details of pricing. The non-profit version of QB Premier uses industry-specific terminology in features and reporting and also includes tools catering to specific and unique needs of the non-profit organizations. It keeps updating the software every year according to the changing needs. The accounting needs is a bit different for every niche entity and QuickBooks gives due consideration to these factors in its programs. It continues to improve with innovative industry-specific application meant for catering to specific domains.

QuickBooks has been at the top of the market for so long and with a reason. QuickBooks Desktop Premier 2019 for Nonprofit Organizations

0 kommentar(er)

0 kommentar(er)